Stay ahead. Stay compliant.

Whether you manage open-end funds, ETFs, closed-end funds, RILA or variable annuity and life insurance products, you need an expert team and technology-driven solutions that streamline your compliance processes, enhance accuracy, and keep you ahead of regulatory changes. From prospectus creation to SEC filings and shareholder communications, Toppan Merrill delivers the precision and expertise required to navigate the complexities of today’s financial landscape with confidence.

Prospectus Services

Built with precision, delivered with confidence.

A Prospectus is the foundation of every fund/product and an essential element of the investment company industry. It all begins with the creation, filing, and distribution and webhosting, which leads to all other compliance requirements and filings.

We support all form types to ensure you meet every ’40 Act compliance requirement, including:

- Annual updates

- New fund launches

- New Variable Products and RILA launches

Minimize compliance risk by leveraging flexible workflows to manage document disclosure through our SaaS platforms and full-service solutions.

Open-End Funds / ETFs

Closed-End Funds

Variable Products

Primary Disclosure Documents:

- Summary Prospectus

- Statutory Prospectus

Primary Disclosure Document:

- Statutory Prospectus

Regardless of your fund type or strategy, we’re here to support your needs:

- Transactional Funds

- Interval Funds

- Tender Offer Funds

Primary Disclosure Documents:

- Summary Prospectus

- Statutory Prospectus

Manufacturing, communication and distribution:

- Portfolio Specific Print

- Daily First Dollar

- Event Processing

- Document Sourcing

Streamline shareholder reporting for compliant investor delivery.

Open-End Mutual Funds, ETFs, Closed-End Funds and Variable Product issuers require solutions for the distribution of shareholder reports. Whether it’s Tailored Shareholder Reports (TSR) for Open-End Funds, ETFs or Variable Products, or Closed-End Funds continuing to take advantage of Rule 30e-3, Toppan Merrill supports the end-to-end creation, filing, print, mail, distribution and webhosting of shareholder reports in compliance with regulatory and business requirements.

Solving the periodic reporting requirements of mutual funds is an ongoing challenge for institutional investment managers and other registered management investment companies. Recent SEC rule changes have increased the complexity of assembling and managing disclosure, plus the change in filing format from html to xml with compressed filing deadlines has added to this complexity.

Toppan Merrill provides service and expertise to meet the evolving filing requirements that impact forms including Form N-PX, Schedule 13D & 13G, Form 13F, Form 40-17G and Form 24F2-NT.

Open-End Funds / ETFs

Closed-End Funds (Traditional, Interval, Tender Offer)

Primary Disclosure Documents:

- Tailored Shareholder Report

- N-CSR

Primary Disclosure Documents:

- Annual Report (30e-3 Notice)

- N-CSR

Proxy Disclosure

Simplify the complex. Deliver compliant annual meeting communications.

The proxy meeting communication and production process can be formidable and complex. To meet shareholder demands, your meeting and proxy process should evolve to increase shareholder participation and effectively communicate objectives.

Whether you manage proxy disclosure for Open-End funds or Variable Products as required, or Closed-End funds for the annual meeting, Toppan Merrill experts are with you at every step in the process to facilitate the composition, filing, print and distribution timeline. Fully integrated workflows ensure projects are completed on time and within your budget requirements.

Solutions and Services

Deep regulatory expertise, built for your SEC disclosure requirements.

The Toppan Merrill investment company compliance service team delivers world-class subject matter expertise tailored to meet the regulatory needs of 1940 Act filers. Your dedicated service team is focused on your specific requirements, offering specialized support for SEC-required disclosures, including annual updates and new product filings.

Backed by 55+ years of regulatory compliance experience, Toppan Merrill combines advanced technology solutions with expert service in composition, EDGAR, iXBRL, print, and distribution. Whether through our SaaS platform or full-service model, we provide the flexibility to manage disclosure documents — ensuring efficiency, compliance and confidence in every shareholder communication.

Your dedicated team includes regulatory experts, operation leads, and service professionals who understand your culture, deadlines, and expectations. This team provides the optimal service model for investment company and other ’40 Act filers. We build around your workflow — not the other way around.

The team are experts in SEC regulations, document assembly and shareholder communications, delivering value through a collaborative support model to manage the overall process and workflow. We listen to what’s important to you and support your priorities with our experience.

Industry knowledge integrated with an understanding of your important milestones allow us to proactively plan for peak activity seasons without losing site of periodic events that occur throughout the year.

Leverage a single-source composition platform to create, duplicate and edit regulatory documents in accordance with SEC regulations, while maintaining brand standards.

Enhanced composition delivers multiple output types from a single source of truth. Our full-service composition platform enables simultaneous output of print and web ready PDFs and SEC compliant html, assembled to meet regulatory and business needs.

Dynamic automated component assembly creates output based on need and can be leveraged to reuse content across multiple documents and filing submissions. Whether a final PDF or components of an EDGAR filing are required, systematic assembly eliminates human error to generate the required the output.

Annual on-time performance = 99.56%

Our EDGAR solution pairs industry expertise with purpose-built technology platforms to generate SEC compliant HTML, xHTML and XML to meet all regulatory requirements. Utilizing our dynamic assembly platform to assemble the multiple documents required in an SEC filing minimizes the risk of error and reduces turnaround time to generate an EDGAR submission.

Annual EDGAR filing success rate = 99.96%

Annual on-time performance = 99.71%

’40 Act XBRL tagging expertise. Since the initial inception of the Risk/Return Summary, Toppan Merrill has been a trusted service provider, keeping abreast of SEC requirements for all required filing form types and XBRL taxonomy updates. Purpose-built technologies ensure proper tag selection for each of the required taxonomies. Plus benefit form an integrated XBRL dashboard that includes an online collaboration portal with automated notifications and alerts.

Using a platform tailored specifically for your line of business is essential for timely, efficient and accurate document production and output.

A customizable, compliant, investor-friendly platform for delivering fund documents — ADA-compliant, brand-consistent, and secure.

With the ever-changing demands for meeting regulatory and business requirements for investor communication, delivery needs and webhosting needs, Publishing Center provides a customizable, branded solution that meets all SEC requirements and removes the challenge of client resource limitations. Publishing Center is document agnostic and supports webhosting of any document type. Customized sites meet client brand standards and regulatory requirements to provide an exceptional user experience.

Developed to meet SEC requirements, Publishing Center meets all regulatory requirements for layered disclosure, internal and external document linking, “mouse-click” rules, ADA compliance, document navigation, download, print and document ordering. Whether we provide fulfillment services for orders placed on our sites or the orders are transmitted to a 3rd party provider, Publishing Center is configured to meet compliance standards for all regulatory deadlines.

Supported lines of business and use cases:

- Open-End Funds / ETFs

- Summary Prospectus Rule 498

- Tailored Shareholder Report

- Closed-End Funds

- Shareholder Report Rule 30e-3

- Variable Products / RILA

- Summary Prospectus Rule 498A

- Tailored Shareholder Report

- Proxy Disclosure (as required)

- Open-End Funds

- Closed-End Funds

- Variable Products / RILA

Dynamically create, duplicate and edit regulatory documents utilizing a shared content library and variable content to maximize content reuse and minimize document editing. Whether managing a new fund launch or preparing annual updates, Toppan Merrill provides end-to-end support throughout the entire process. Deep understanding of the regulatory framework, combined with the ability to adapt to your specific business needs and workflows, ensures the resource and operational backstops needed to meet deadlines and production milestones.

In addition to our ’40 Act focused service and operations teams, the SEC Compliance Services team works closely with the SEC staff and industry groups to provide interpretative guidance in a direct partnership with clients on the impact of those regulations.

Add investor value by through improved content accessibility

ADA compliance provides and bridges the gap between the ADA regulation and your company’s culture and governance to provide compliance accuracy for individuals with and without disabilities.

We’ll partner with you on the review of your documents and website to aid in your compliance and identify areas to minimize reputational and litigation risk.

Annual document remediation (Year-over-year growth) = 23%

Deliver personalized, rule-based shareholder communications.

Our dynamic document assembly solution is a purpose-built platform that meets regulatory communication requirements by providing personalized, portfolio-specific shareholder communication.

Individual shareholders receive portfolio-specific Prospectuses, Shareholder Reports and Supplements specific to the products they’re invested in. Based on business rules, documents are dynamically produced and automatically assembled and distributed through the designated paper based or electronic delivery method, optimizing manufacturing and postage costs.

The document sourcing module allows insurance companies who offer variable life and annuity products to distribute fund holding documents under the regulatory requirements in a timely manner.

Document sourcing brings assurance that any changes or modifications to fund documents are captured in real time.

Modern delivery, investor preferences tracked and managed.

Although delivery of printed materials is still the default for documents regulated by the SEC, our eDelivery platform supports event processing, as well as one-off requests for investors who consent to electronic delivery.

Toppan Merrill Delivery Preference Center (DPC) tracks and stores delivery preferences and preference changes for efficient document delivery management and reporting.

The right equipment to maximize efficiency.

Integrated digital and offset print platforms support speed, quality and efficiency for projects of every size and scope. Toppan Merrill will guide you through the manufacturing process, identifying cost savings and manufacturing efficiencies by selecting the right equipment for the right job.

We partner with you to process mailings efficiently and apply the highest possible discounts.

Maximize USPS postage discounts through our National Change of Address (NCOA) certified mail services and CASS certify addresses to ensure compliance with USPS discount requirements, improve delivery rates and realize manufacturing efficiencies. Postage discount levels vary based on mail quantity, list concentration and mailing method – such as presort, comingling, first-class, or marketing mail.

For 55+ years, companies have relied on the experience and expertise of the Toppan Merrill team.

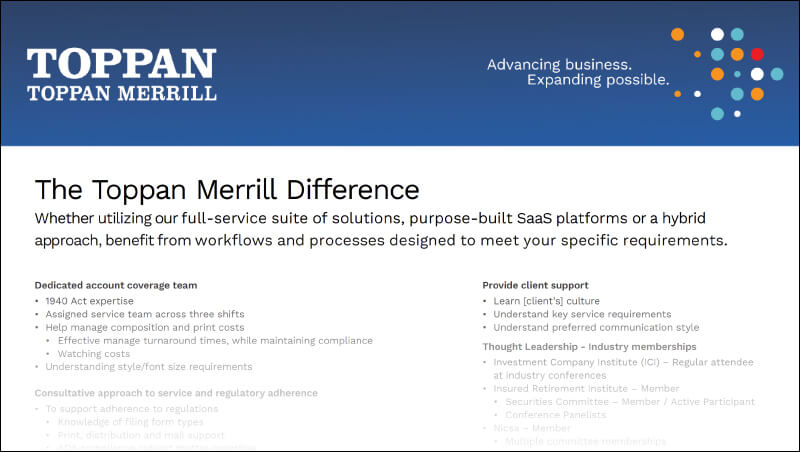

The Toppan Merrill Difference

Trusted by leaders. Proven by results.

Whether utilizing our full-service suite of solutions, purpose-built SaaS platforms or a hybrid approach, benefit from workflows and processes designed to meet your specific requirements.

“As always, the Toppan Merrill team provided excellent service for these prospectus filings – kudos to Marisa and Dave for their quick turnaround and patience as we worked through the new iXBRL filing process.”Senior Associate Counsel, Life Insurance Corporation