The SEC continues their focus on effective corporate governance and transparent executive compensation disclosure with the adoption of the Insider Trading disclosure final rule.

The new rule is part of a growing regulatory and market demand for ESG data and practices by corporations. The SEC has adopted a suite of related ESG rules in the past few years, including Pay Versus Performance, which requires Inline XBRL tagged data in an issuer’s proxy statement related to a company executive compensation compared to the company’s performance.

Insider Trading Arrangements and Related Disclosure (Rule 10b5-1)

The new rules are intended to close gaps in existing SEC regulations to prevent insider trading. The SEC amended Rule 10b5-1(c) that governs the affirmative defense to insider trading. The amendments expand cooling off periods and place more limits on trading plans for officers and directors. The changes are designed to prevent insiders from trading company stock based on material company information that is not yet publicly available.

Issuers and corporate insiders must comply with a range of new policy and disclosure requirements, including iXBRL tagging in company applicable filings. The SEC adopted related Form 4 and 5 technical and disclosure changes, which I detailed in a recent blog post.

Affected filers: Domestic and foreign private issuers

Compliance Timing

- Large accelerated and accelerated filers must comply with the disclosure requirements in periodic reports on Forms 10-Q, 10-K, and 20-F, and in any proxy or information statements in the first filing that covers the first full fiscal period that begins on or after April 1, 2023

- Note: Form 40-F is not covered in the rule

- Smaller reporting companies have an additional six months to comply, beginning with the first filing that covers the first full fiscal period that begins on or after Oct. 1, 2023

The SEC published guidance on May 25, 2023, to clarify the compliance timing. Large accelerated and accelerated filers with a fiscal year end of 12/31 need to comply with their upcoming second quarter 10-Q filing in August 2023.

The SEC adopted an array of iXBRL disclosure and tagging requirements under the rule including:

- Rule 408(a) requires quarterly disclosure related to any adopted or cancelled trading plans by officers or directors

- Reporting begins with the 10-Q for the period ended June 30, 2023, for affected filers. Any fourth quarter plan changes would be reported with the 10-K.

- Rule 402(x) requires issuers to disclose annually in their annual report on Form 10-K and/or proxy statement information about their insider trading practices and procedures

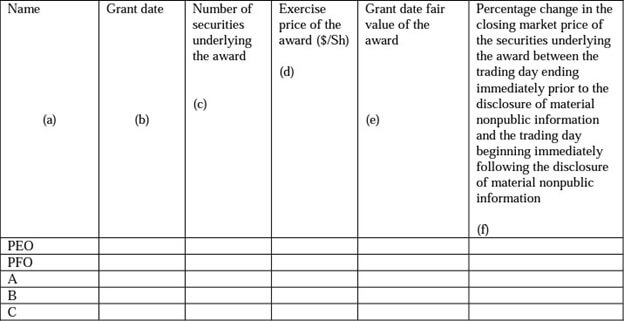

- Additionally, Rule 402(x) requires narrative and tabular disclosure of options awards, for officers and directors close to that time when a company releases material nonpublic information (such as an earnings release) and related policies and procedures

- Issuers must report in their 10-K and/or proxy statement. Similar to the quarterly disclosure of any changed insider trading plans, it is likely that issuers will structure their options awards to minimize or eliminate any transactions within the material event window.

- The options award table must follow the following format, as mandated by the SEC:

We expect that issuers may structure their insider trading plans and option awards to minimize their new quarterly and annual reporting requirements, to the extent possible.

Additionally, registrants will need to file their insider trading policies as an exhibit to their annual report on Form 10-K, and on Form 20-F for foreign private issuers. The exhibit is not required to be iXBRL tagged.

- Rule 408(b) requires issuers to file an exhibit which details their insider trading policies and procedures

- The exhibit is not required to be Inline XBRL tagged

Any company required to report insider trading tagged data this year must utilize the 2023 Executive Compensation Disclosure (ECD) taxonomy. Filer should ensure that their reports are utilizing the most current SEC XBRL taxonomy.

Should you have questions about the new insider trading requirements or simply want to speak with a Toppan Merrill expert about getting started with our SaaS platforms, Bridge and SEC Connect, connect with us via [email protected] or by phone at 800.688.4400.